We’re allergic to investing fees.

Why fees matter

Investing fees are bad for the same reason that inflation is bad: they both quietly eat away at your purchasing power.

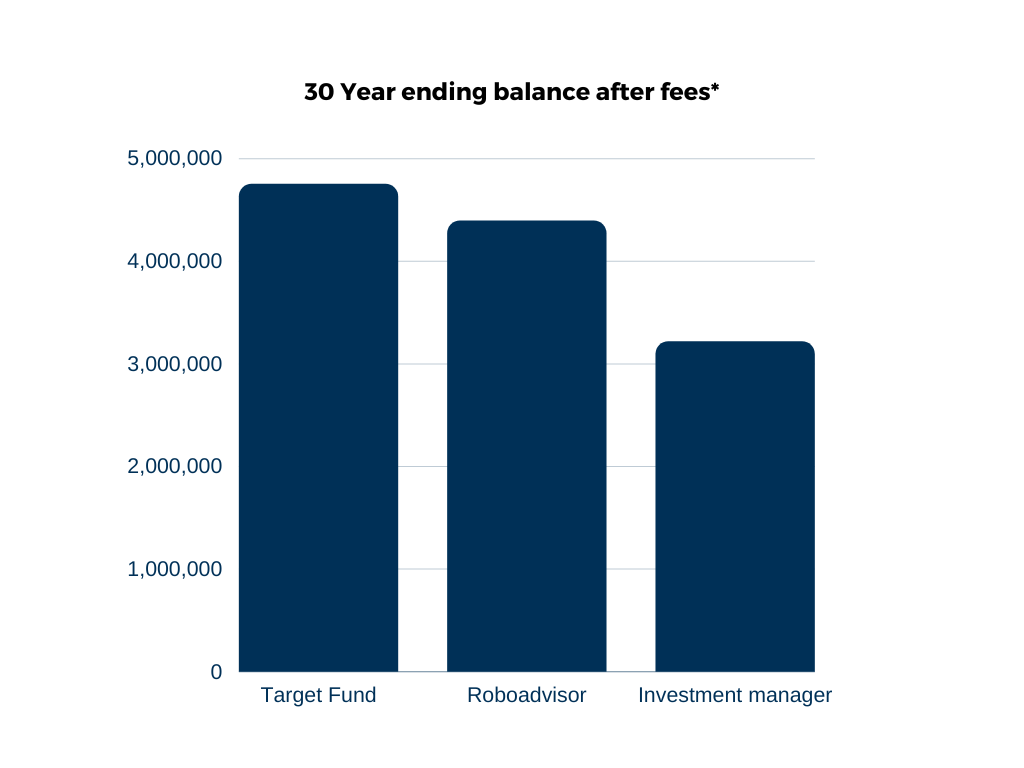

Most investment managers charge 1-2% annually to manage their clients assets. At first glance that sounds reasonable since it gives them skin in the game. But it rarely plays out that way in reality. Despite all the incentives to perform well, the data is clear that almost all advisors underperform Index Funds. And that 1-2% fee they charge can leave you with hundreds of thousands of dollars less in your portfolio than had you just invested in Index Funds.

Use a fee calculator

We think it’s worth playing around with a calculator so you can see how fees impact you. The calculator below lets you compare three investment fees side-by-side.

How to get human help

Getting help from a real person isn’t bad at all – often times, it’s the best! The trick is making sure that you find someone who has your interest at heart and isn’t trying to profit off your portfolio size with excessive Assets Under Management (AUM) fees.

We stand by investing in Index Funds on autopilot, but also suggest working with a Certified Financial Planner (CFP) for times when you need more help – like when you’re buying a house, doing tax planning, etc.

You can find a CFP by going to NAPFA’s directory and searching by hourly rate advisors who are licensed in your state.

Ready to Invest?

*The graph at the top illustrates just how badly fees can drag on your portfolio’s performance over 30 years. In this example, the person who invested in the Target-Date Fund ends up 1.5 million dollars richer than the person who used the investment advisor. We used all the same numbers except for the investment fee percentages. $500,000 initial investment + 10k/yr contribution with a 7% annual return over 30 years. The Target-Date Fund fee has 0% fee, Roboadvisor .3% fee, and investment manager 1.5% fee.